He knew what he was voting for.

Indeed.

The headline figure was 19% in 2021 but then pushed up to 25% that year.

We have our problems too. After covid-19 and the subsequent economic problems, the state is now at a point where it has started to cut spends in all departments (apart from the military, which gets more than before).

What’s more, the army of billionaires here who pay relative short change in taxes (and are protected by the majority of politicians from the right), stands out when compared with more and more people experiencing serious problems to get at the end of the month. That is building up a lot of mistrust and anger.

That’s why there are several popular initiatives building up now to try addressing this. The previous ones didn’t make it and were rejected by a majority of people, who were sold the ‘trickle-down-effect’. But I wouldn’t be surprised if that changes in the near future. People here are accustomed to have rich people around them, and don’t care at all as long as they are well off themselves. But they don’t like blatant inequity, and the more and more obvious arrogance and unwillingness from these billionaires to pay their dues will end up with laws forcing them to pay.

But as said, in order to be effective, there needs to be a global cooperation on taxing the super-rich and the multinational companies, and I very much hope that we’ll get there sooner rather than later.

Eu is actualky starting that. Uk didnt like that idea and we all know what followed ![]()

Is this what you are referring to?

If thats the anti tax avoidance directive thats certainly part of it.

This will make some on here happier.

Somehow, despite being good news, this will make some on here unhappier.

Yes, I noticed that. Oddly enough, I was reading an article on “cheapflation”, excess inflation on budget priced goods:

It’'s a bit technical, but it shows that when there is an inflationary shock, for example from an energy crisis or currency devaluation, then the prices of goods at the budget end of the market will increase faster than those at the premium end because there is very little room for the suppliers to absorb costs.

It does make the case for having a separate inflation index for essential living as the CPI inflation rate is used for increases to pensions and benefits, which will often be received by those who are most exposed to cheapflation.

It’s such good news as my weekly stay in a local Hilton to smoke 100 Regal Kings is now slightly cheaper. Absolutely cracking stuff. With the money I save I’ll buy a new pipe and some St Bruno, might push the boat out and get a suite.

If you want to look at your personal inflation rate, the ONS has a tool here:

https://www.ons.gov.uk/visualisations/dvc1833/calculator/index.html

It might be interesting to see how you win or lose against the official rate over time (there is a graph of your personal inflation vs CPI at the end.)

Just as an example of the cheapflation thing, I thought that I would run a few scenarios through the ONS personal inflation tool.

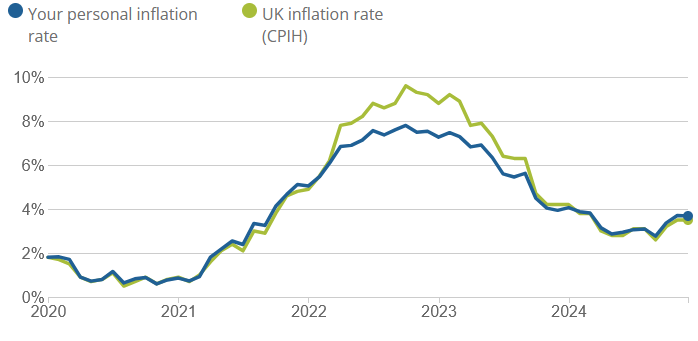

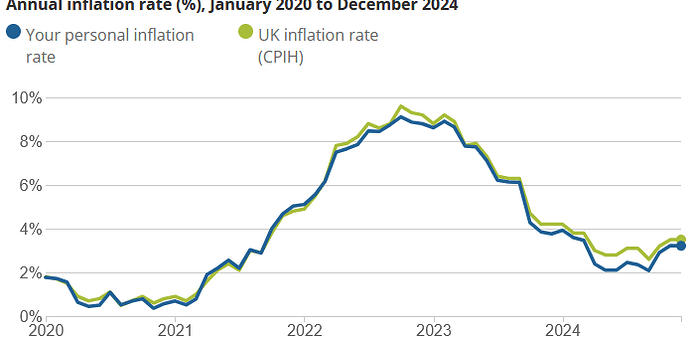

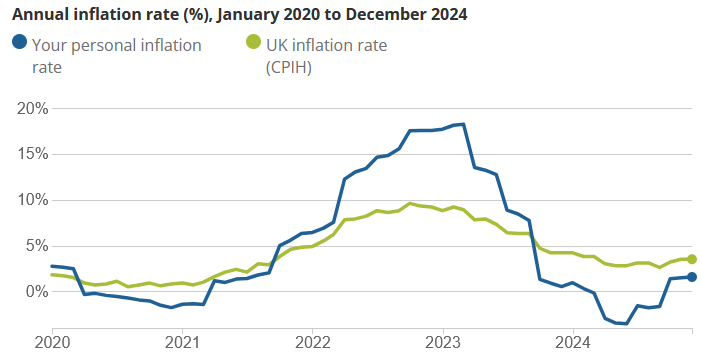

These are three scenarios with the yellow (UK CPI rate) compared to the blue (personal inflation rate).

First example is someone with £10,000 monthly income; A top rate taxpayer with a sizable mortgage and children. You can see that they were less exposed to the peak in inflation in 2022/23:

The second example is £2,200 monthly income (average - although not sure if mean or median), paying rent with child costs and so on. They match the CPI quite closely:

Finally, a lone pensioner with £1000 monthly income and no rent or mortgage. This individual is the most exposed to price fluctuations:

It’s telling how someone on the lowest income is exposed to the wildest changes in experienced inflation.

Of course, that is only half the story, because the lower the household income, the closer to the financial break.even point they will be. What could, to our wealthy family, be a moderate decrease in disposable income, could easily be a sink-or-swim situation for the less well off.

Fantastic tool, that. It would be interesting to see them all with the same Y-axis, but that spike to damn near 20% is frightening - one of the lessons of a century ago is that inflation like that is inimical to democracy. When people see a deterioration like that in their standard of living, it doesn’t take long for the desire to find someone to blame to take hold. As we have seen in the US, there is usually someone else there happy to point the finger.

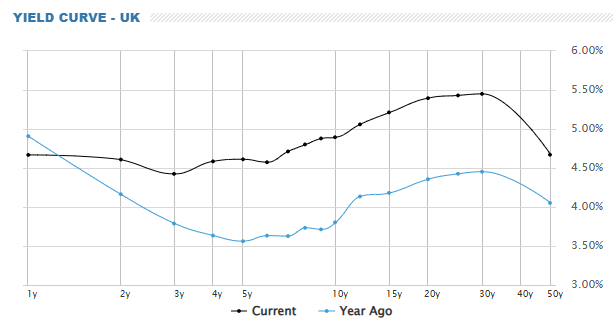

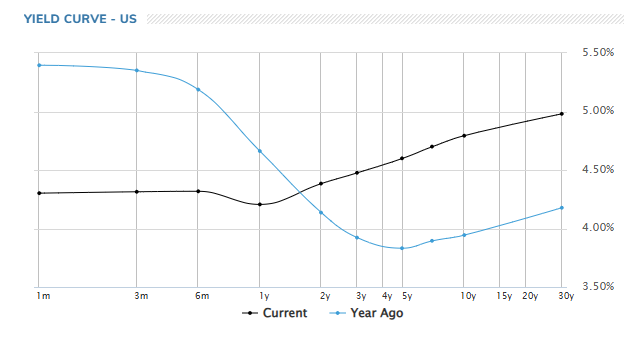

In happier news, that decline in inflation has given Reeves 10 basis points of breathing room. Not enough, but I suspect twice as much as she had yesterday. The yield curve is still abnormal, suggesting a lot of uncertainty in the 3-5 year horizon (compare to last year)

of course, at some point the market might start looking at the weirdness of the US Treasury yield curve rignt now and give the UK a break.

I’m wondering how much the market is trying to fathom what the US market will do with the Trump presidency. There are also German elections coming up, but that is far more predictable.

I was listening to one podcast this morning that pointed out that the excess borrowing during Covid was on unusually short term bonds. I’m wondering whether that had a bearing on the timing of last year’s general election - essentially, they knew that the bonds were about to reach maturity and cause an issue for the current chancellor.

It amazes me that you still get people in denial of climate change. Then you realise that they are fully cognisant of it, but simply don’t care and want to profit as much as they can in the short term.

Cunts.

The US yield curve has gone from a very problematic inverted a year ago to what looks like a transitional set of expectations around what happens when Trump is in charge - but very clearly inflation is anticipated. At some point, the UK starts looking like a better place to park money than the US.

Does this include “internal inflation” that arises from spouses owning your wallet?

The majority of non believers think its a scam to pay more tax.

Thick as shit

Doesnt the US have some big chunk of debt to refinance in the next couple / few months?

The FED will want interest rates as low as possible for that and a bit of inflation. Open season after that I guess.