Crazy stuff. Those Bahamians got some ‘splainin’ to do.

Para 65 is nice. Check out what they could do throughout the world with one group email. Yikes!

- The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets. Mr. Bankman-Fried and Mr. Wang controlled access to digital assets of the main businesses in the FTX Group (with the exception of LedgerX, regulated by the CFTC, and certain other regulated and/or licensed subsidiaries). Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).

Appropriate names

This one is also nice.

- One of the most pervasive failures of the FTX.com business in particular is the absence of lasting records of decision-making. Mr. Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same.

There has been some suggestion on twitter last night that he is positioning to put all the blame on his ex girlfriend who was head od Alameda.

She will, of course, claim the opposite. She was harassed subjected to an unequal power arrangement. And she’s not a major shareholder, I do not think. That bankruptcy filing was basically a shout at prosecutors to come have a look. Surely, some of this is illegal. Will be interesting to watch to see if he perp walks.

I loved this comment, too. WSJ quoting the bankruptcy filing.

"FTX’s new chief executive, John J. Ray, said in a bankruptcy-court filing on Thursday that the company’s financial information wasn’t trustworthy and that it was controlled by ‘a very small group of inexperienced, unsophisticated and potentially compromised individuals.’”

Does he mean they were stoned, mentally underdeveloped (notice I did not say “retarded”) or financially beholden to others?

This is great

I know there are some Planet Money fans here, and Jacob is one of the original and long time hosts of that podcast. This is from his new one that focuses on innovative problem solvers, people who have thought about problems in novel ways to produce big leaps forward. In the summer he interviewed SBF, and it was from that interview that the popular “I’ll spend $1b on elections” quote came from. This is a revisitation of that interview to piece out new context given what we now know.

I thought it was really well done and pretty insightful. The big take away is that the misapplication of Expected Value. The way they talk about it makes a ton of sense wrt philanthropy. Far less so when talking about investing other people’s money in an unregulated industry…at least if you’re the people whose money is being invested.

Tesla now trading down at a 2 year low of $167. That’s what, $750B of lost market cap from it’s peak? Is there any potential for the board to move against him (any more than they have already been forced to over the stock manipulation issue)?

this boggles my mind.

“FTX didn’t have a bank account that customers could send money to; Alameda, the hedge fund, did. So they would wire the cash to Alameda, and FTX would add it to its account. And, in all those years, Alameda never passed the cash on. No one noticed, and the firm apparently traded, and lost, $8bn of customer funds that it should never have had in the first place.”

how…what? how the…who is monitoring…what??

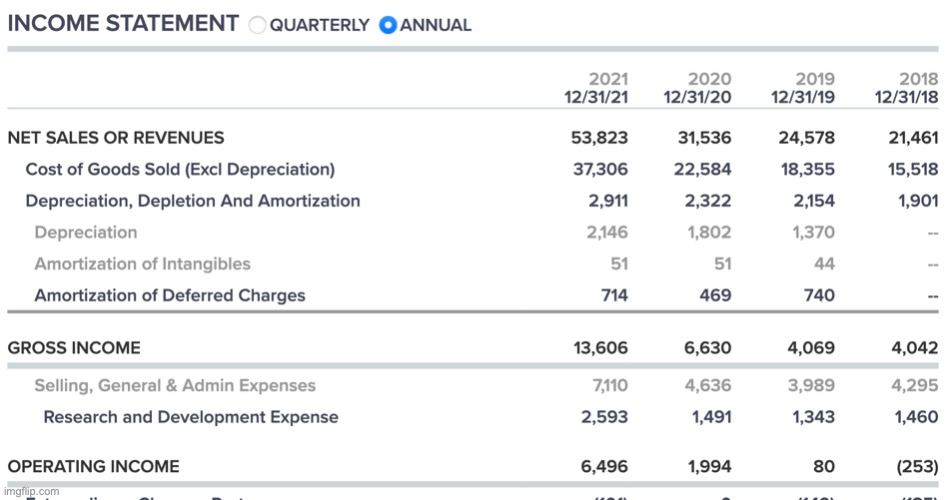

Not likely. Take a look at the company’s sales and profit growth. It’s phenomenal. He’s not in any danger at Tesla anytime soon.

I do think many Tesla shareholders are looking askance at this Twitter diversion. They’d like him back to spending more time on Tesla pronto. If that continues for too long, the clamor grows louder.

We disagree about the actual strength of the company. They have clearly made big inroads in tangible productivity in the last 12 months or so, but their valuation is still way off in ways that make them massively susceptible to even further loss of market cap in ways at odds with whatever relatively small in comparison gains they make in car sales. They fact most of their growth comes from China is also something that is probably something to be conscious of.

However, that is besides the point. My question wasn’t will they remove him, it was about the structure of the board and what capacity they have to do so. I know there was an SEC enforced shake up of the board several years that saw him get removed as chair and had 2 new (non-Elon connected people) added, but it still seems a very Elon connected group.

Musk is a bit of a knucklehead, to be sure. Lots to criticize on his personal comportment. The business case is pretty clear, though.

Look at the growth ramp of vehicle sales. Note that Q4 2022 is not yet included. To drool over.

The growth is obviously positive but representative of how little of an actual car company they have been for most of their existence. It is still tiny numbers in comparison to competitors. And, critically, the bulk of the growth comes from China. Somewhere where commercial success is always hanging on a kinfe edge, especially for a non-chinese company. But those are the fundamentals and Tesla has never been priced on its fundamentals. If it was to be now, even with these improved figures, the stock price would collapse. So, if there is a lot of vapor propping up its share price then Musk’s antics risks even further losses to to shareholder value and market cap in ways that cannot be mitigated by pointing to being a small scale car company who are dwarfed by their competitors.