‘It’s almost as good as May’s deal’ ???

There was no expectation that financial services would have the full ‘passport’. However, there was no expectation that the UK would accept a deal that had no provision at all for financial services - most organizations accepted there would be some rebalancing, and uncertainty on where precisely that would fall.

As it is, other than time zones, it now makes as much sense for TD to run many of those operations out of Toronto as London. CETA Chapter 13 quite possibly offers better access to the EU from Canada.

The asymmetrical aspect is that the EU has retained access to the UK goods market, at the expense of some transactions costs (time and paperwork) which can be alleviated by some of the trusted trader schemes. As such, the balance in favour of the EU and the corresponding deficit on the UK side can be expected to continue. Services were in surplus for the UK, with a very large percentage of that financial services. Those services no longer have the same access to the EU, some now completely excluded.

That is a genuinely weird table. Two of those are basically the same point, laws and judges. So at best, 3 of the 8 points cited were actually the subject of the negotiations, the other 5 are simply properties of Brexit.

Shhh don’t tell anyone. They think they’ve nailed it…

Magical thinking on both sides of the Channel…Von Der Leyen said this:

"Of course, this whole debate has always been about sovereignty. But we should cut through the sound bites and ask ourselves what sovereignty actually means in the 21st century.

“For me, it is about being able to seamlessly do work, travel, study and do business in 27 countries. It is about pooling our strength and speaking together in a world full of great powers. And in a time of crisis, it is about pulling each other up. Instead of trying to get back to your feet, alone."

That all sounds very cool, but it isn’t sovereignty.

From what I’ve been told the EU will be granting the UK equivalence status on financial services allowing UK financial services to operate in the EU as before. Only snag is that the EU can withdraw that perhaps on as little as 30 days notice

I had not heard that - is it in a side-letter or some such thing?

I don’t know. I just asked a mate of mine who has very high level connections in UK and EU financial services. He’s definitely on the remain side as well so have no reason to think he’d spin it positively. He considers that the EU need London more than the other way around. Doesn’t think there’s any chance London will be replaced as the foremost European financial centre.

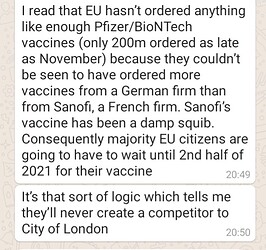

Just recently sent me this further observation

Incidentally, that’s more optimistic than I am. Strange times!

Why do you think that hasn’t that been published as part of the deal?

That seems odd considering how big a thing it is.

Obviously. Have you ever been to Wales or Stoke? Or worse still Leeds?

If Kopstar’s source is correct, with a 30-day withdrawal period, it isn’t really part of the deal. Just a side letter to assure the UK side that the City does not grind to a halt in a fortnight.

It’s certainly good news, I just thought it was bizarre that it wasn’t announced.

But hey ho, another positive.

under which the EU allows them to conduct certain financial activities. Equivalence rights can be withdrawn at short notice

I just don’t get what leverage the UK has left after this trade deal that would benefit us in financial services negotiations. If we were in the EU’s shoes, what would stop us from absolutely gutting the financial services industry over the long term?

This damp squid just goes to show that Franco/british projets are always set to fail. Yes Sanofi is French as is it’s vaccine development branch Sanofi/Pasteur, GSK is British.

The vaccine isn’t that bad tbf but isn’t near the pfizer one for efficacity.

On the other hand I can not see the equivalence of pharmaceutical procurement and the financial services.

We debated the finacial sector on TIA I think coming to the conclusion that London would remain important. What’s your bud worried about?

Why would the EU want to gut something they hope to expand? or are you just refering to gutting the UK financial services business?

London will always have a place no doubt about it. Once someone get’s their money into the UK, and the financial regulations along with the channel islands and Caiman islands makes that very attractive, the services will be demanded.

I was meaning EU gutting UK

Actually you touched on a point there. I understand that Boris wants to open the UK to foreign investment i.e. allowing more Russian oligarchs with blood money etc. into the UK.

The EU was very much looking to close this loop off.

How will this be handled? EU just give 30 days notice if the UK misbehaves?

He’s not, at all. I’m the one with the reservations.

You can sing and dance, but as an Anglo-Irishman living in Germany, I’m deeply sad about the whole business. Of course the EU can be criticised, but so can Westminster. No system is perfect. Europe needs unity in order to face the challenges ahead, and the EU and the UK need each other and have to work together. You want to fall into the arms of the USA? Or China? Good luck with that. It’s all deeply depressing and self destructive in my opinion.