Those kids are scarred for life!! Poor kids.

There are plenty of kids more deserving of our sympathy.

I wonder if he sends his own kids up the chimneys to sweep them ![]()

For some reason Rees Mogg always reminds me of this chap.

The child catcher terrified me as a kid. Lots of nightmares ![]()

Snowflake.

Me too, that film still terrifies me to this day.

Sometimes, you can’t choose your parents.

Apparently, one of his sons is a massive Liverpool supporter. So, we can live in hope.

Not if he is notasuperfan

Maybe we’ve finally unmasked @The-AllMightyReds. Would explain a lot.

has to be @PeachesEnRegalia

something about the finesse of his posts always made me feel he was from good stock, with an education to match his standing

Is it mandatory to be a Rotarian for becoming a minister?

No, just a freemason.

Reported. And thank you.

Let’s hope they keep lurching to the right. That would make them unelectable for years to come.

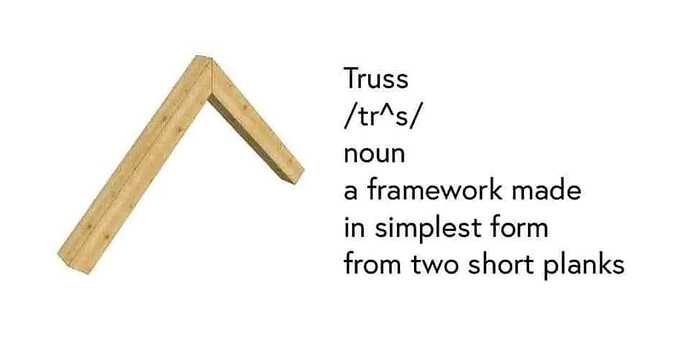

Sometimes the old ones are the best - or I need to bring my research up to date :0)

Yeah… will definitely have to throw out some of my old material :0)

Last one… Promise :0)