I think it’s important to recognise that we are playing around with supposition based upon conjecture derived from estimates so that we could be wildly wide of the mark, either way.

We have no idea to what extent our media income will be impacted by TV rebate or by our final positions in the Premier League and Champion’s League. And given the way we are currently playing …

It’s difficult to predict which way commercial revenue might vary, and in which direction. Over the last 10 seasons it has grown on average by 17.8% per season, however there have been wild fluctuations season on season, including one season with negative growth and another with effectively zero growth.

I have no idea what impact the pandemic might have, so I’ve just included commercial revenue at the level projected by Deloite for 2019/20.

By far the biggest element of our Operational costs are our employment costs. In 2018/19 these totalled £309.9 million, or 58% of turnover. The departures of Lallana, Lovren and Clyne will have reduced the bill but with Thiago and Jota coming in (with signing fees?), together with one or two improved contracts for key players I don’t see much overall change. There hasn’t been any indication of a players’ pay reduction, so I have assumed that it will remain at or about its previous level.

With the fall in turnover suggested by Deloite this element will represent an even higher percentage of turnover i.e. 64%.

With regard to player trading we have no idea as to how payments, and receipts for players, are structured. Nor do we know how agents’ fees are paid i.e. lump sum or incremental over the duration of the player’s contract.

However we do know (from the statement of cashflows) that the net cash outflow for 2018/19 was £59 million, and for 2017/18 £49 million.

I don’t know how much of a change we can expect in this figure for the subsequent periods, so I have used the average net spend over the last five years of c. £48.7 million.

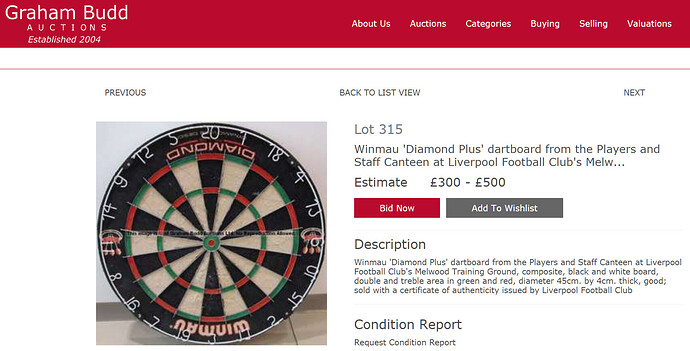

Finally we have to consider the costs of acquiring tangible fixed assets i.e. final costs for completing the Kirkby training facility which I estimated to be c. £25 million offset by what ever was raised from the sale of the Melwood site (c. £10 million?).

This is an interesting point, and one I’ve been digging into for a little while.

Yes the relaxation FFP rules mean that the owners can put more money into the club, without incurring penalties but I don’t believe FSG have a (substantial) pot of cash to draw upon.

I recall, whilst going through the Mill Finance v. RBS legal documents, reading that NESV’s final offer for the club was the maximum they could live with.

Furthermore it transpired that NESV intended to obtain the proceeds to make their bid by drawing on a new term loan with BofA and on their (currently) undrawn revolver.

So it would appear that NESV/FSG were not sitting on substantial cash reserves, but were reliant upon borrowed funds to complete the deal.

I’m not sure how this situation might have changed much during the intervening period seeing as they haven’t taken a dividend out of the club.

Consequently I suspect that if FSG have to bail us out they might have to borrow the money to do so.

The combined profits, for the seasons 2017/18 & 2018/19 was £139.4 million after tax, most of which came from player sales. (Operating profit for the same periods was a much more modest £7.8 million.)

This does not mean that the club had a combined pot of £139 million to spend. Profit does not equate to cash surplus especially when the profit is derived from player trading.

At the end of May 2019 the club had cash and cash equivalents of £37.5 million. At the same time it still owed the bank £49.5 million, so effectively £12 million in the red, not to mention the outstanding £79.3 million inter-company loan.

Loss of matchday revenue and media revenue are effectively cash losses and impact directly on operating profit and cash flow.

Based upon these various assumptions, and the presumption that repayments on all loans are deferred until post Covid, we could end this season with an availability, including cash and cash equivalents together with the balance of the bank revolver facility of less than c. £40 million.

I really do hope my projections are wide of the mark, even to the point of being made to look foolish, but we are potentially looking at a situation where we might fail to qualify for the Champion’s League, with all that implies regarding loss of income, but lacking the funds to bring in the talent to rectify the situation.