What makes this different is that he has not hitherto dabbled with his unique brand of grift in areas regulated by the SEC. In this case, I think he may have outsmarted himself pumping up the initial value. The interest expense is non-cash, this is basically a NASDAQ-listed NFT. All the headlines right now are about the huge loss, but it is just bullshit value now being revealed as bullshit, not a real loss at all. But with a momentum stock, that becomes really problematic - and puts the Board he expected to rubberstamp his early stock sales in an awkward regulatory position.

Murkier and murkier…

https://x.com/SRuhle/status/1780966570434388014

You cannot oppose Trump through normal channels without your safety being on the line. But don’t call it fascism.

Lots of reporting during the week about seeming anomalies with the civil trial bond. It now seems the NY AG is looking to get it nullified

https://x.com/KlasfeldReports/status/1781405951284617543

Judge Engeron is going to have a hearing about it on monday morning, the same day his campaign finance trial starts a couple of miles awau ![]()

The crazy thing is that with the Cayman Islands tie-in, this is just a step or two away from also involving the Everton takeover.

You have been warned.

Again.

He’s his own worst enemy. At a time when the electorate are being reminded daily of just how odious he is , and when his focus needs to be on attracting swing voters and independents , he goes and gives an interview like this that should scare the living daylights out of anyone who wants to go on living in a lawful democracy. I think he’s having a seriously hard time now containing his anger at the perceived injustice of his trials and that these outbursts will become more frequent and more alienating. Keep up the good work Donald.

The vicious mob boss is starting to reveal his true colors. For many years there have been threats here and there along the way, coupled with not paying your bills, and scamming and cheating people out of money. It’s all there, and he hasn’t been caught or held accountable.

Now that justice is slowly starting to rein him in, he has the brass neck to openly threaten the President?

Whoever dares to vote for him, shame on them! I understand that Biden might not be your cup of tea, but this fella is actively tearing down the country and the right choice at the ballot box must prioritize the country over the mob boss.

American values have been sliding toward authoritarianism for a long time now, with only the fetishistic gun freedoms not having been significantly eroded in the past two generations. The right-libertarian streak that was so unique to America has largely metastasized into racism and resentment. The shift in thinking about personal freedoms that occurred after 9/11 was enormous, yet passed with minimal cultural comment. I think the US is now in a really grim state politically, and it is hard to see how the polarization can be turned around. I doubt it has been this bad since the 1850’s, and even then there was more of an underlying consensus of what the state could demand of the citizen

I agree with all of that, and would add, sticking Trump back in would almost cement the process of it becoming an authoritarian state.

So hopefully enough people see that, and vote accordingly in November.

It won’t magically solve all the issues, but it will be an important step in the right direction.

I think the American view of freedom has always been a bedfellow with authoritarianism. Most people now are familiar with Wilhoit’s law as it applies to Conservatism - [it] consists of exactly one proposition …There must be in-groups whom the law protects but does not bind, alongside out-groups whom the law binds but does not protect. It is very easy to rephrase that with respect to freedom and not say anything different. As such, Americans have never cared about freedom as a general concept, but only how it impacts them and have long been totally ok with violating the freedom of other people to protect what see as their own freedom. I think that is the central attraction of authoritarianism - give me the license to exert my freedom at the expense of these other people.

Maybe. I used to have a more optimistic take at least some of the time.

The aforementioned Time interview with Trump.

" What emerged in two interviews with Trump, and conversations with more than a dozen of his closest advisers and confidants, were the outlines of an imperial presidency that would reshape America and its role in the world. To carry out a deportation operation designed to remove more than 11 million people from the country, Trump told me, he would be willing to build migrant detention camps and deploy the U.S. military, both at the border and inland. He would let red states monitor women’s pregnancies and prosecute those who violate abortion bans.He would, at his personal discretion, withhold funds appropriated by Congress, according to top advisers. He would be willing to fire a U.S. Attorney who doesn’t carry out his order to prosecute someone, breaking with a tradition of independent law enforcement that dates from America’s founding. He is weighing pardons for every one of his supporters accused of attacking the U.S. Capitol on Jan. 6, 2021, more than 800 of whom have pleaded guilty or been convicted by a jury. He might not come to the aid of an attacked ally in Europe or Asia if he felt that country wasn’t paying enough for its own defense. He would gut the U.S. civil service, deploy the National Guard to American cities as he sees fit, close the White House pandemic-preparedness office, and staff his Administration with acolytes who back his false assertion that the 2020 election was stolen.

Trump remains the same guy, with the same goals and grievances. But in person, if anything, he appears more assertive and confident. “When I first got to Washington, I knew very few people,” he says. “I had to rely on people.” Now he is in charge. The arranged marriage with the timorous Republican Party stalwarts is over; the old guard is vanquished, and the people who remain are his people. Trump would enter a second term backed by a slew of policy shops staffed by loyalists who have drawn up detailed plans in service of his agenda, which would concentrate the powers of the state in the hands of a man whose appetite for power appears all but insatiable. “I don’t think it’s a big mystery what his agenda would be,” says his close adviser Kellyanne Conway. “But I think people will be surprised at the alacrity with which he will take action.”

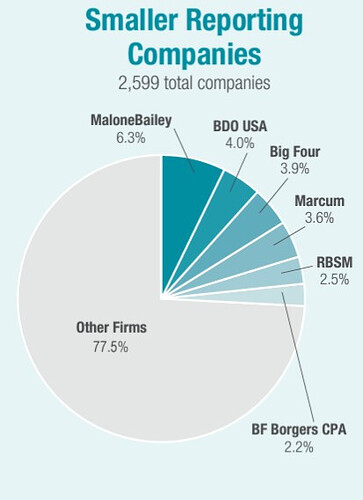

To be clear, no direct association in this case with the work for Trump Media. But 3/4 of its audits were found to be fraudulent…

This is mindblowing

This is a massive regulatory failure. This is a one-man shop producing over one public company audit a week.

Edit : The Lincoln Project said the ad will run this weekend on NBC during the Kentucky Derby coverage and on Fox News Sunday morning. It will also run digitally at Mar-A-Lago, so he and his donors will definitely see it.

![]()

So what would happen if this were to be confirmed post November elections but prior to being swarn in in January? Would the presidency just go to whoever his running mate is, or would there be some other protocole for this?